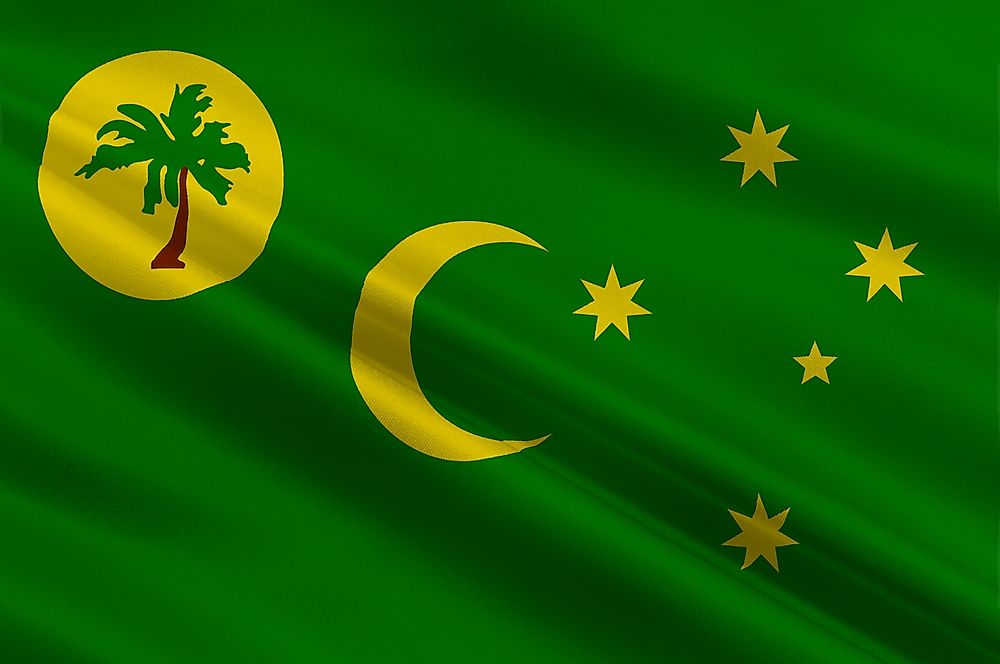

Internet Center for Management and Business Administration, Inc.The Coconut Island Analogy is a thought experiment popularized by online content creators such as Vaush and Adam Something, which seeks to demonstrate the inherently coercive and unjustifiable nature of capitalist property norms and, more specifically, the concept of wage labor.ĭespite it's popularity (or perhaps due it to, depending on how charitable we are being), the flaws with this analogy are immense, in both their scale, and in how they destroy the validity of the contention implicit within it. Home | About | Privacy | Reprints | Terms of UseĬopyright © 2002-2010. The concept of opportunity cost has a wide range of applications including: In many cases, the relative price provides better insight into the real cost of a good than does the monetary price. If a consumer goes to the grocery store with only $4 and buys a gallon of milk with it, then one can say that the opportunity cost of that gallon of milk was 2 loaves of bread (assuming that bread was the next best alternative). Opportunity cost is expressed in relative price, that is, the price of one choice relative to the price of another.įor example, if milk costs $4 per gallon and bread costs $2 per loaf, then the relative price of milk is 2 loaves of bread. Note that this simple example assumes that the production possibility frontier between fish and coconuts is linear. By expressing the cost of one option in terms of the foregone benefits of another, the marginal costs and marginal benefits of the options can be compared.Īs another example, if a shipwrecked sailor on a desert island is capable of catching 10 fish or harvesting 5 coconuts in one day, then the opportunity cost of producing one coconut is two fish (10 fish / 5 coconuts).

For example, if one has time for only one elective course, taking a course in microeconomics might have the opportunity cost of a course in management. It often is expressed in non-monetary terms. Opportunity cost is useful when evaluating the cost and benefit of choices. Adding this amount to the educational expenses results in a cost of $165,000 for the degree. If the student had been earning $50,000 per year and was expecting a 10% salary increase in one year, $105,000 in salary would be foregone as a result of the decision to return to school. However, when making the decision to go back to school, one should consider the opportunity cost, which includes the income that the student would have earned if the alternative decision of remaining in his or her job had been made. This is the monetary cost of the education. For a two-year MBA program, the cost of tuition and fees would be $60,000.

Consider the case of an MBA student who pays $30,000 per year in tuition and fees at a private university. Opportunity cost contrasts to accounting cost in that accounting costs do not consider forgone opportunities. Any decision that involves a choice between two or more options has an opportunity cost. While the cost of a good or service often is thought of in monetary terms, the opportunity cost of a decision is based on what must be given up (the next best alternative) as a result of the decision. Scarcity necessitates trade-offs, and trade-offs result in an opportunity cost. Scarcity of resources is one of the more basic concepts of economics. Economics > Opportunity Cost Opportunity Cost

0 kommentar(er)

0 kommentar(er)